In the garment industry, time is money. And with a busy schedule, it’s hard to stay up-to-date with industry trends. That’s why SGIA conducts its annual Industry Benchmarking Survey, for which we surveyed 119 garment decoration companies in 2018. The following is a breakdown of some of our key findings.

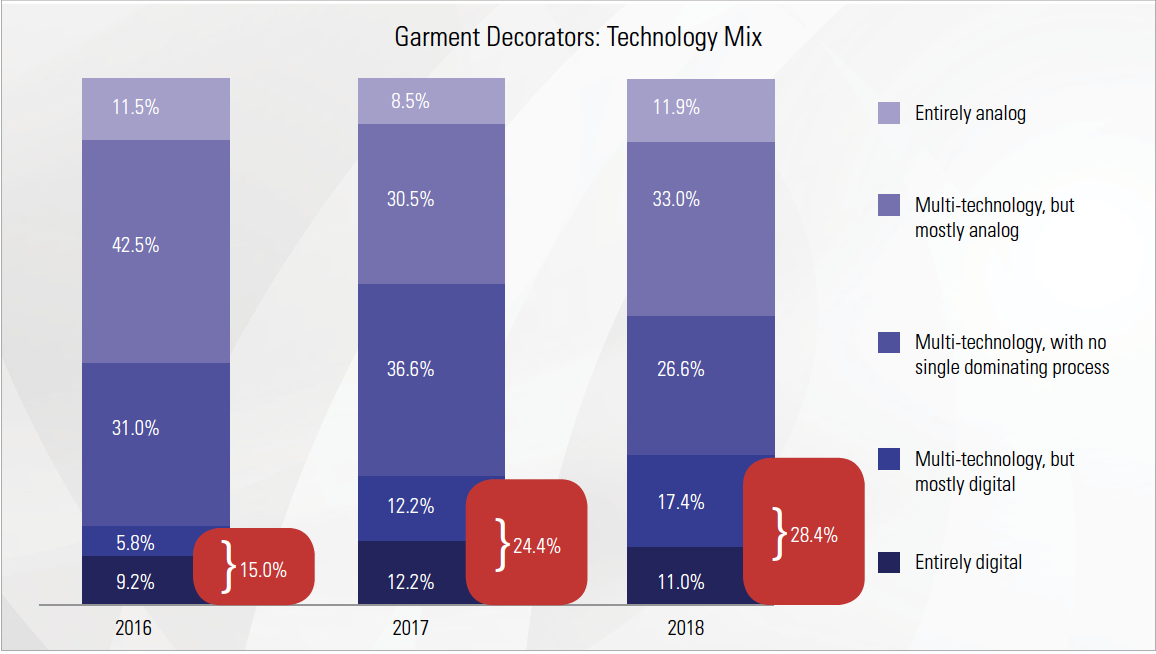

At least half of the companies surveyed have 10 or less employees, and their median sales revenue is $1.1 million. When it comes to equipment, garment decorators are increasingly using digital: the number of those using digital almost doubled since 2016 (from 15% to 28%). Does the type of equipment impact the way companies run their businesses? According to the survey, digital companies are equally focused on business-to-business (B2B) and business-to-consumer segments, whereas companies with analog equipment seem to be more focused on B2B clients.

We also looked at finishing services, which the majority of respondents provide, whether via analog or digital. Bagging/tagging, fulfillment, sewing, warehousing and grommeting are the most frequently provided types of finishing. Providing finishing services, however, hasn’t increased the use of production facilities, as those providing them and those that aren’t had very similar average production in use. However, when asked about barriers to growth, downward pressure on prices was more of an issue for those not providing finishing/post-production services. We believe that finishing is a value-added service that strengthens the relationship with the customer and better justifies pricing. Finding new customers and recruiting/retaining production personnel were the other two main challenges — however, the latter is a greater issue for those with analog equipment than for those with digital.

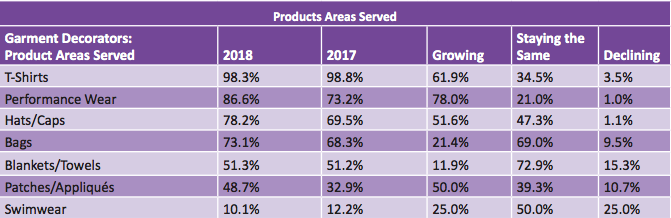

Garment decorators primarily serve the athletic, educational institution, business-to-consumer, nonprofit and corporate branding markets and consider these to have the highest growth potential. The most popular products are T-shirts, performance wear, hats/caps and bags. The first three were identified as growing areas as well. The popularity of patches and appliqués is also on the rise, especially among companies with analog equipment.

Garment decorators primarily serve the athletic, educational institution, business-to-consumer, nonprofit and corporate branding markets and consider these to have the highest growth potential. The most popular products are T-shirts, performance wear, hats/caps and bags. The first three were identified as growing areas as well. The popularity of patches and appliqués is also on the rise, especially among companies with analog equipment.

The majority of companies indicated having sales and production increases for the current year, with their upcoming year’s expectations even higher. Their confidence in the industry and the economy is also high. In other words, the future looks promising!

For SGIA’s full industry benchmarking reports and other research, visit SGIA.org.